A Primer on the Proposed 2024 Hastings-on-Hudson School Budget

Registered voters can vote on the school budget on May 21st

By Keith Berman, Ed.M., M.S.Ed.

Hastings-on-Hudson – On Tuesday, May 21st, Hastings-on-Hudson residents will descend on the Cochran Gymnasium in Hastings High School to determine the fate of the school budget.

The budget was shared in an overview on March 5th, in a detailed presentation by Superintendent William McKersie on March 19th and at the School Board meeting on April 3rd by Business Official Maureen Caraballo. It was then adopted by the Board of Education on April 16th, and explained in both a public hearing on May 7th and a PTSA/SEPTA forum on May 8th.

The Board of Education Trustees also distributed budget details and summaries in the “Hastings Happenings” newsletter and posted information on the district website, including an FAQ about the budget.

“The reason we have all these presentations is to give people time to realize that this is happening. And we will have more mailers coming out even in the coming week. The budget is 100% transparent,” School Board President Alex Dal Piaz shared.

“We tasked the administrators with going back and making a budget that is tax cap compliant that doesn’t cut any of the services that reach the children, and they did. It was really a tough year to do this, and districts around us sometimes cut millions in programs, but ours did not,” he added.

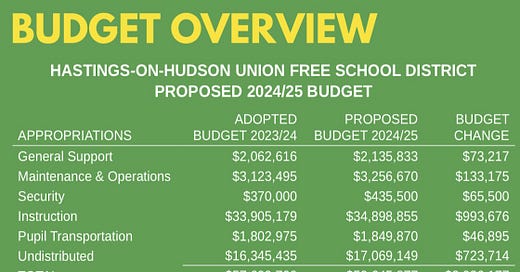

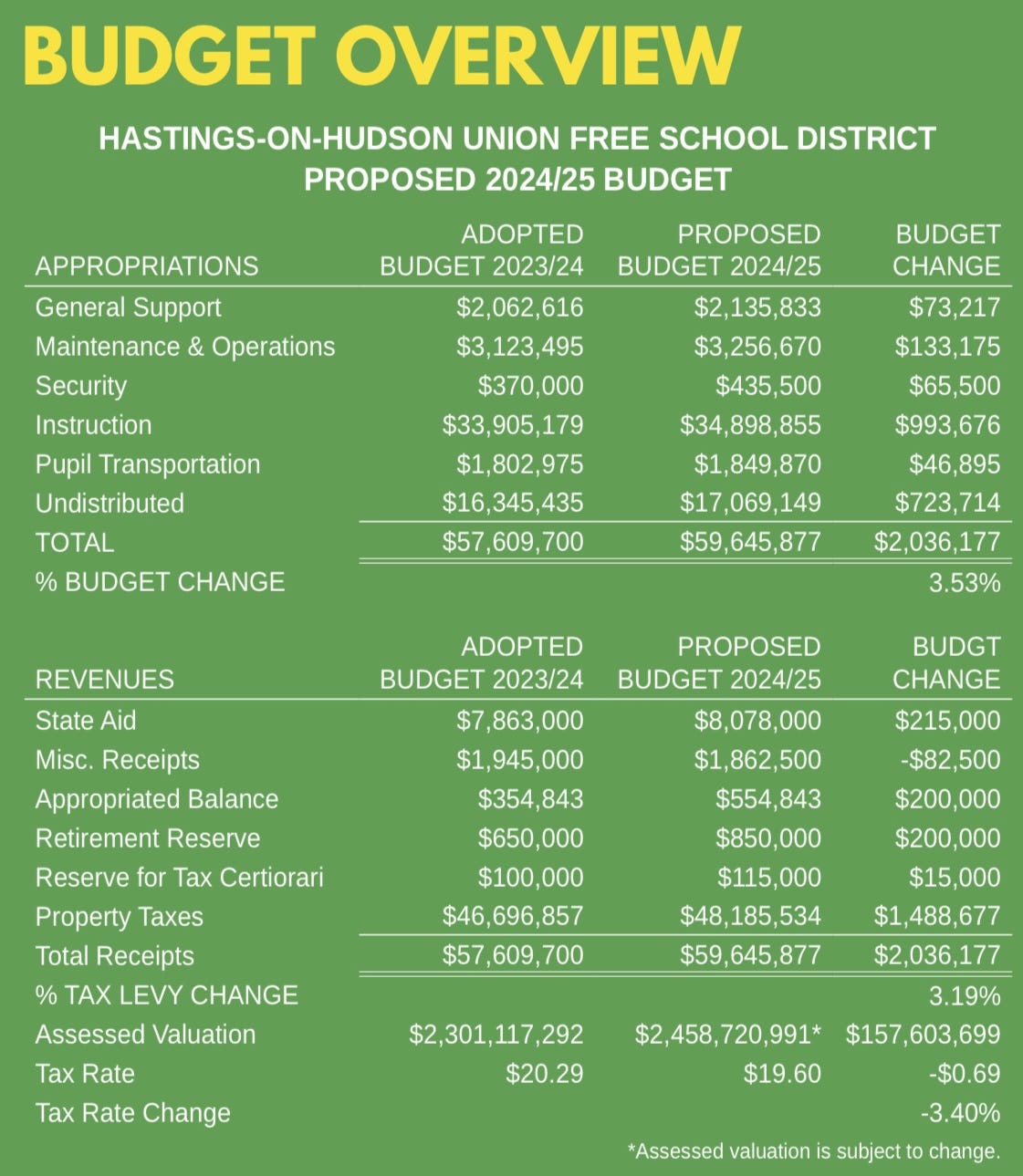

Fiscal discipline was a theme in this year’s budget. The 2024-5 budget-to-budget increase in spending over the previous year is 3.53% and the proposed tax levy change is 3.19%. Those numbers are in line with the 3.5% increase in the Consumer Price Index, a US government measure of inflation, over the last 12 months.

Among the Rivertowns, Hastings has the lowest proposed tax levy despite mandatory contractual increases, health insurance premiums growing by 11% and the addition of two special education teachers at Farragut Middle School. Ardsley’s proposed levy is 3.27%, while Dobbs Ferry’s is 4.28% and Irvington’s is 3.41%.

Jeffrey Bernstein, who spent eight years as a Hastings Board of Education Trustee and is a longtime Hastings resident, shared his perspective: “School boards should always be mindful of the entire community, and have a duty to be as fiscally responsible as possible when drafting a budget. School budgets are educational plans. Defeating a budget disrupts that plan, and often creates an environment where our students are not getting the best education they can,” Bernstein said.

Dal Piaz said that the priority is to make sure that school funds are spent in good faith.

“A lot of the money reaches the kids,” he told the Rivertowns Current. Since 2021-2, instructional spending in Hastings has ranked 1st out of 48 schools in its peer group (source: the Putnam Westchester BOCES Negotiations Clearinghouse).

One commonly misunderstood feature of school budgets in New York is reserves and how they are used. “Reserves” are money that has been set aside by a school district over time in order to save for anticipated expenses or projects.

As detailed in the budget summary, the Hastings district is using reserves to lessen the overall tax impact. The Budget FAQ states, “Yes, the district is recommending the use of reserves to offset the 2024-25 budget. Reserves have been created and funded for specific liability purposes. The district recognizes the current financial pressures on taxpayers and is proposing an increase in the use of the reserves to lessen the impact on taxes while maintaining personnel and programs.”

In the past, the practice of using reserves in the school budget resulted in some citizens and business owners challenging the real estate assessments of their properties.

Christine Wong, a residential and commercial real estate attorney in New York City, explains further: “It is not uncommon for property owners to challenge the municipality's tax assessment. Successful tax challenges can result in a reduction of funds to a school district, and some school districts are responsible for their share of any tax refund issued to property owners. The amount of any such refund will vary, depending on the number of tax challenges in any given year. A school district may establish a reserve account to cover any such expense.”

In the Hastings school district, the reserve is not a general emergency fund; rather, it has specific liability purposes, among which are “tax certs,” liability reserves, employee benefits, retirement expenses, debt services, and insurance. Because of these reserves, if a teacher gets hurt or a field gets flooded (reserves were used for Reynolds Field after Hurricane Ida in 2021), key programs are not cut, as might happen in a state like Connecticut, where districts can run into problems because they don’t have reserves.

One of the priorities in the budget, aside from not cutting programs and exhibiting fiscal discipline, was addressing COVID learning loss. Dal Piaz and others were happy that the district kept the Math Interventionist (who works both at Hillside and the Middle School), and summer supports. Also of priority was maintaining $25,000 in funding for the theaterprogram.

“It was a really tough year to meet the standard of a tax cap without cutting programs, and [the administrators] did it,” said Dal Piaz.

Registered Hastings voters can vote from 7 AM until 9 PM on May 21st at Cochran Gymnasium at Hastings High School. To vote absentee, contact District Clerk Melissa DeLaBarrera at 914-478-6402.

Looking for another way to support Rivertowns Current?